While browsing the news lately, one might have noticed that one topic has enjoyed substantially more coverage than usual. That topic is biodiversity.

Part of the attention was caused by a landmark agreement on biodiversity at the end of the UN Biodiversity Conference COP15, chaired by China, that was held in Montreal in December 2023. The agreement includes to halt and reverse nature loss, effectively putting 30% of the planet and 30% of degraded ecosystems under protection by 2030. Furthermore, wealthier nations committed to pay $30 billion a year by 2030 to poorer countries for their work on protecting and restoring biodiversity [1] .

Yet it is important to highlight, that these political developments did not evolve in isolation, but are rather the result of academic research and private initiatives discovering and emphasizing risks to the global economy by the continuing deterioration of the world’s ecosystems and biodiversity loss.

Given the changing political landscape and the international consensus to enhance biodiversity protection, it is high time for financial institutions and companies to prioritise biodiversity on their agendas and integrate this topic into their day-to-day financial decision-making.

This blogpost deep dives into the topic of biodiversity elaboring its rising importance in a global context and for financial institutions and real-economy companies. How can risks be managed and opportunities leveraged?

Biodiversity – why bother?

We have all heard through one way or another, that the growth of human population and our economy puts pressure on the natural world. Often associated images include rainforest destruction, over-fishing or hunting, intensive agriculture or oceans filled with plastics (unfortunately, this list is not exhaustive).

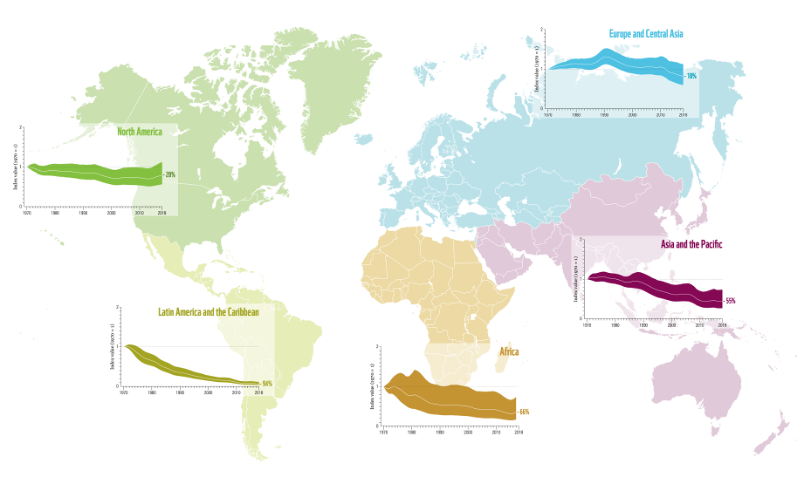

Fortunately, data allows us to track the intactness of biodiversity over time, for example by measuring the state of the world’s biological diversity based on population trends of vertebrate species from terrestrial, freshwater, and marine habitats. The Living Planet Index (LPI) is one of the most important indicators for measuring the current state of biodiversity. In 2022, the index included data from almost 32,000 vertebrate populations worldwide – mammals, birds, fish, reptiles and amphibians. The data set is constantly updated and expanded to include more species and habitats worldwide.

So, despite the complexity of the natural world, one graph can summarize the effect human activities have had on the planet. Between 1970 and 2018, the biodiversity intactness decreased by a staggering 69%, with a continental variation between 18% in Europe and Central Asia and even 94% (!) in Latin and Central America.

Graph 1: The global living planet index is a measure of the state of the world’s biological diversity based on population trends of vertebrate species from terrestrial, freshwater and marine habitats (WWF 2022).

Biodiversity loss should not just be a concern for David Attenborough enthusiasts, but a top priority for business executives that are keen to manage their organizations’ impacts, risks and opportunities responsibly. Finally, a decline in biodiversity should also concern anyone who is committed to limit global warming, as both issues are inextricably interlinked and cannot be tackled efficiently in isolation [2].

How is the economy affected?

Direct Risk: Dependence on Ecosystem Services

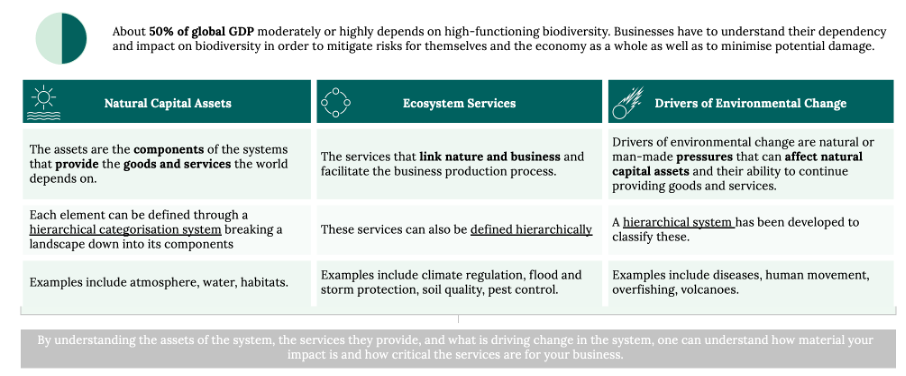

As made painfully clear in the past three years, economies do not thrive in a market environment of crisis, volatility, and unpredictability. The biodiversity crisis has the potential to exacerbate those issues remarkably. A study published by the World Economic Forum (WEF) estimated, that $44 trillion, or half of the worlds GDP, is generated in industries dependent on nature, including biodiversity [3]. This places biodiversity on 3rd place in the 2022 WEF Global Risk Perception Survey [4].

At this point it seems worthwhile to explain -in brief- how biodiversity-related losses are materializing:

Biodiversity is crucial for national economies as it underpins ecosystem services that are vital for agriculture, fisheries, and tourism, all of which contribute significantly to GDP and job creation. Healthy ecosystems also enhance resilience against climate change and natural disasters, reducing economic losses and ensuring long-term sustainability. Moreover, biodiversity provides a source for raw materials, medicinal resources, and genetic diversity, fostering innovation and economic growth. However, withour current way of conducting business , we deteriorate the natural capital assets, and consequently the basis for valuable ecosystem services (see Table below).

Table 1: How biodiversity risks materialize and exacerbate through human activity (Magnolia).

While those impact numbers are assessed on the economy-level, sector-specific impacts can vary significantly in extend and risk drivers. Above all, food, agriculture, and construction face the highest direct impact of biodiversity loss.

Let’s look at examples, to demonstrate how biodiversity risks can materialize:

- A relatively straightforward example of risk includes the loss of insects, especially bees, that provide the service of pollination for agriculture. That service alone, is estimated to be worth between $195-387 billion annually [5].

- Biodiversity is critical to drug discovery with around half of all approved modern drugs being developed from wild species during the past 30 years[6].

- The ecosystem service provided by filtering air and water is at risk through the decline in algae, anima, microorganism and (non-)vascular plants which may impact cross-cutting sectors [7].

Although financial institutions are generally not directly impacted by biodiversity risk, they internalize the indirect risk associated with their assets. Given their exposure, it is understandable why the financial industry is pushing the agenda on biodiversity conservation during the last COP15 [8].

Transition risks – reputation

There is a growing segment of consumers making conscious decisions about the biodiversity impact of their purchases. An example includes the poor reputation of palm oil processed in various products given its impact on rainforest destruction [9]. If companies leave their biodiversity impact unmanaged, they may face decreasing sales through reputation risks harming entire markets. Similarly, a poor reputation for biodiversity negligence may cause implications with financial institutions that themselves set biodiversity related targets in the future.

Transition risk- regulation

If the above-mentioned risks were not convincing enough to voluntarily engage on biodiversity, regulation (at least in the EU) will soon require businesses to do so.

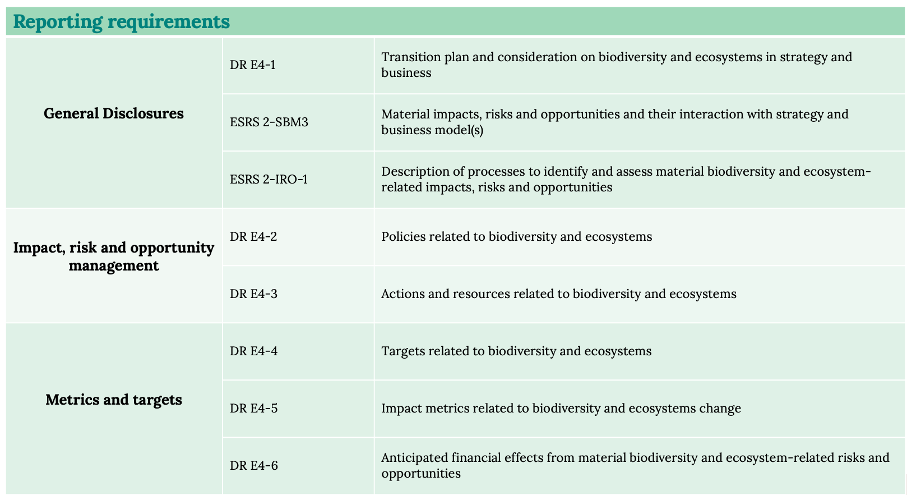

The significance is already understood by the legislator in the EU, hence the consideration under ESRS E4 [10] of the CSRD. This applies to all companies in the EU with roughly 250 employees or more and requires the following disclosures on biodiversity.

Table 2 Biodiversity-related reporting requirements from the European Sustainability Reporting Standard E4

After demonstrating the relevance of managing biodiversity as a topic on an economy- and company scale, the question remains what companies can do to leverage opportunities and avoid associated risks. The activities associated with “business as usual” are fueling the loss of nature, so we clearly must change our way of doing business.

Managing nature impacts, risks and opportunities – a path forward for organizations

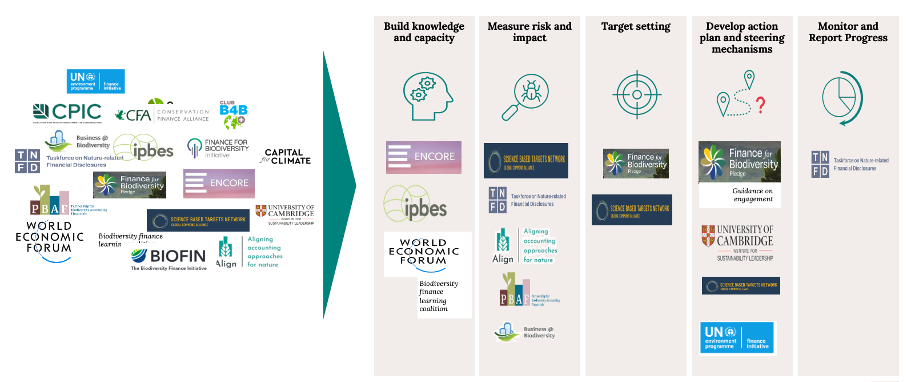

As biodiversity attracts more attention and resources, the multitude of frameworks, initiatives, guidance, alliances, and coalitions make it difficult to know where to start!

Drawing from our expertise in climate strategy, we drew up a five-step approach on how to approach biodiversity efficiently and categorized selected initiatives by their purpose.

- Building knowledge and capacity:

While the mechanisms of climate change are complicated, human contribution can be summarized by excessive CO2e emissions. In contrast, the contribution of a single operation to the loss of local biodiversity requires deeper understanding of the system and its dependencies. Finding the correct metric to measure impact may vary between natural capital, impact driver and ecosystem services. Organizations should develop an understanding of the topic and how their value chain is dependent on and has an impact on nature.

- Measure:

Various tools and frameworks have been developed to assess the dependency on ecosystem services and natural capital assets and quantify the resulting risks and impacts. The method selected depends on your business, however, Finance for Biodiversity provides an excellent overview of the currently available tools [11].

- Target setting:

Target setting protocols such as that of the Science Based Targets Network (SBTN) offer an infrastructure promoting transparency and accountability. One recommended benchmark would be to set a target matching the regulatory ambition of the EU Biodiversity Strategy 2030 [12]. The targets should be measurable, actionable, time-bound and based on the best available science.

- Action plan:

Develop an action plan, that details how to achieve the target through own actions or wider value-chain as well as public policy engagement. The actions should reflect a hierarchical order, where (a) harmful actions are avoided, (b) existing harmful activities are reduced, (c) impacted nature assets are restored and regenerated.

- Disclosure and report:

To get a head start for your mandatory CSRD disclosure, sign up to TNFD or comparable voluntary disclosure frameworks.

Conclusion

Biodiversity is a key topic that is only going to increase in importance in the future. Although it may be difficult to understand initially, it is highly rewarding from a risk and strategy perspective. Magnolia recommends to identify which stage of the biodiversity journey you are on and work from there. Keep in touch with updates for any of the stages, as the topic is still under development. If biodiversity cannot be tackled internally, Magnolia Consulting can help across the stages, and particularly integrate it with existing efforts towards your decarbonization strategy.

[1] https://www.cbd.int/article/cop15-cbd-press-release-final-19dec2022

[2] https://ec.europa.eu/research-and-innovation/en/horizon-magazine/climate-change-and-biodiversity-loss-should-be-tackled-together

[3] https://www.weforum.org/reports/nature-risk-rising-why-the-crisis-engulfing-nature-matters-for-business-and-the-economy/

[4] https://www3.weforum.org/docs/WEF_The_Global_Risks_Report_2022.pdf

[5] https://link.springer.com/article/10.1007/s12571-020-01043-w

[6] https://www.swissre.com/dam/jcr:a7fe3dca-c4d6-403b-961c-9fab1b2f0455/swiss-re-institute-expertise-publication-biodiversity-and-ecosystem-services.pdf

[7] https://encore.naturalcapital.finance/en/ecosystem_services/8

[8] https://www.unepfi.org/themes/ecosystems/cop15statement/

[9] https://www.wwf.org.uk/updates/8-things-know-about-palm-oil

[10] https://www.efrag.org/Assets/Download?assetUrl=%2Fsites%2Fwebpublishing%2FSiteAssets%2F11%2520Draft%2520ESRS%2520E4%2520Biodiversity%2520and%2520ecosystems%2520November%25202022.pdf

[11] https://www.financeforbiodiversity.org/publications/overview-of-initiatives-for-financial-institutions/

[12] https://www.eea.europa.eu/policy-documents/eu-biodiversity-strategy-for-2030-1