Environmental, Social, and Governance (ESG) risks are increasingly recognized as critical factors in assessing the health and resilience of financial institutions. These risks stem from climate change and environmental degradation, social issues such as inequality or labour rights, and governance failures like corruption or weak oversight.

But ESG risks don’t just threaten reputations—they can undermine the stability of entire institutions. Think of climate-related disasters damaging collateral, social unrest affecting business continuity, or governance failures leading to litigation and regulatory sanctions. Left unmanaged, these risks can translate into real financial losses, credit deterioration, and long-term exposure for banks and their clients.

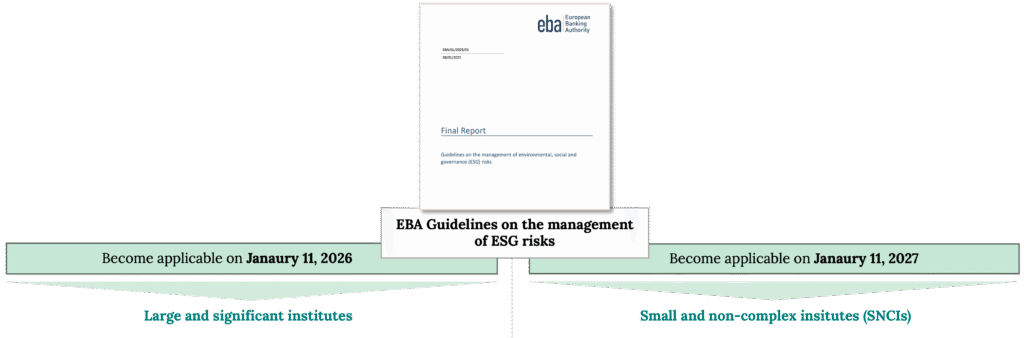

In response, the European Banking Authority (EBA) released its final Guidelines on the management of Environmental, Social, and Governance (ESG) risks, on 9 January 2025. These guidelines mark a significant advancement in integrating ESG considerations into the risk management frameworks of EU financial institutions, aligning with the Capital Requirements Directive VI (CRD VI) and supporting the EU’s broader sustainability objectives.

When do the new rules apply?

For most institutions the guidelines will come into force from January 11, 2026. Recognizing the diversity among financial institutions, the EBA allows for proportional application of the guidelines. Small and non-complex institutions (SNCIs) are granted an extended timeline, with the guidelines becoming applicable to them by 11 January 2027.

Moreover, SNCIs are also permitted to use simplified approaches in implementing the requirements. This means they can adopt less granular methodologies, streamline their materiality assessments, and reduce reporting burdens, as long as their ESG risk exposure and internal capabilities justify it.

At a Glance: Core Elements of the EBA’s ESG Guidelines

- Identification and measurement of ESG risks & materiality assessment

The guidelines emphasize the importance of conducting regular materiality assessments to determine and measure significant ESG risks. Institutions must ensure high-quality data collection and analysis to support these assessments and inform risk management decisions. In order to assess ESG risks, precise information and new analytical approaches such as scenario analyses are required.

- Integration of ESG risks into risk management

The EBA mandates that institutions embed ESG risks into their overall risk management processes and frameworks. In addition to identifying and measuring ESG risks, this includes, managing, and monitoring ESG risks across all traditional risk categories, such as credit, market, operational, and reputational risks.

- Strengthening governance structures

The guidelines emphasize the importance of robust internal governance. Institutions must clearly define roles and responsibilities for ESG risk oversight, ensure that the management body is actively involved in ESG-related decisions, and integrate ESG considerations into the institution’s overall governance framework.

- Development of prudential transition plans

Institutions are required to formulate prudential transition plans that outline strategies for managing ESG-related financial risks. These plans must include clear roadmaps and science-based targets, ensuring alignment with the EU’s goal of achieving climate neutrality by 2050 and be consistent with other EU legislative requirements.

- ESG risk reporting and monitoring

Institutions are expected to develop comprehensive internal reporting systems for ESG risks. This includes setting up reliable metrics, key risk indicators (KRIs), and consistent monitoring mechanisms to inform decision-making and support transparency in both internal and external disclosures.

The Ripple Effect: What the EBA ESG Guidelines Mean for Borrowers

While the EBA’s ESG risk management guidelines are primarily directed at financial institutions, their implications extend well beyond the banking sector. Borrowers—particularly corporates and SMEs—should pay close attention for several reasons:

- Increased ESG Scrutiny in Lending Decisions

Banks will now assess ESG risks as a core part of their credit evaluations. This means borrowers with weak ESG practices or exposure to high ESG risks may face tighter lending terms, higher capital costs, or even limited access to financing.

- Need for Enhanced Transparency

As banks are required to report on ESG risks and demonstrate how these are integrated into their decision-making, they will demand more detailed and reliable ESG-related data from their clients. Borrowers will need to improve their sustainability disclosures to meet these expectations.

- Alignment with Transition Planning

Borrowers, particularly in carbon-intensive industries, may be asked to demonstrate their own transition strategies to align with the EU’s climate goals. Banks will increasingly favour clients who show credible transition plans toward decarbonization and sustainable growth.

- Reputation and Relationship Management

Strong ESG performance can enhance a borrower’s reputation and solidify relationships with banks that are under growing regulatory pressure to partner with sustainable clients. Those who align early can become preferred partners in green and sustainable finance products.