Introduction

The Carbon Risk Real Estate Monitor (CRREM) is a widely used and free-of-charge tool providing real estate climate transition pathways. It has updated its decarbonization curve in cooperation with the SBTi. Until now, there were differences between these two widely used transition pathways. The new pathways now require the sector to become even more ambitious and adjust their emissions targets to stay aligned to latest climate science. However, the cooperation now ensures a common framework with consistent assumptions, definitions, and methodology. Hence providing clear guidance for the real estate sector and its future endeavors with regards to climate change mitigation.

What is the CRREM? What is the SBTi?

CRREM provides 1.5°-aligned targets for operational carbon emissions for real estate assets. It has developed decarbonisation pathways with trajectories for different regions and property-types as well as associated climate risks. The excel-based CRREM-tool supports investors and banks to evaluate their portfolios as well as individual assets.

The Science Based Targets initiative (SBTi) provides science-based target-setting frameworks and validates companies’ emission reduction targets. These targets need to be in line with halving global emissions before 2030 and achieving net-zero emissions before 2050. The sectoral decarbonisation curves provided by the SBTi include real estate pathways for services and residential buildings.

Both real estate curves are widely used and so far, market participants have faced the challenges of inherent differences between the two.

The cooperation with the SBTi

In January 2022 the two organizations have started a cooperation to provide fully aligned 1.5°C as well as 2°C pathways for the real estate sector. These are the so-called “CRREM-SBTi-pathways”. Different pathways for different use-types and regions of real estate properties are being developed. After the collaboration of both initiatives from January to August 2022 a consultation paper was released in October 2022 with the consultation taking place until 10th of November 2022. The feedback is now under review. The final pathways will be published in January 2023.

The advantage of the cooperation for users is the combined expertise of both partners in forming one global standard for decarbonization in the real estate sector all the while ensuring the conformity of underlying assumptions, carbon budgets and an overall consistent methodology. Therefore, companies in the sector have a clearly defined and freely accessible guidance which can be used for target setting and risk analysis.

SBTi benefits of the cooperation by accessing more granular pathways for the building sector. The previous pathways were only split into the categories residential and commercial buildings.

Methodology

The CRREM and SBTi use a downscaling approach to arrive from global carbon emission requirements to the final pathways per subsector and country.

The initial point of orientation is the Paris Agreement with the 1.5°C-goal, which the pathways align to. Then, CREEM uses anthropogenic carbon budgets derived from the Intergovernmental Panel on Climate Change (IPCC) (with 50%-likelihood to achieve the 1.5°C scenario) as well as emission pathways aligning to the energy models by the International Energy Agency (IEA). Next, an appropriate share of the global carbon budget is allocated to the real estate sector based on floor area, growth rate and sector activity compared to other sectors.

Afterwards, the Sectoral Decarbonization Approach (SDA) is used to arrive at national building sector pathways, breaking them down into residential and commercial property types. The SDA is a method used to distribute the remaining global carbon budget to sectors based on the cost efficiency principle. This means that the SDA uses mitigation potential and abatement cost data by the IEA to find national carbon-intensity pathways within the given carbon budget.

Eventually, the last step is to further break down the commercial and residential sectors into sub-sectors (single- & multifamily residential, office, retail, hotel, healthcare, etc.). This is done using individual national sources and aggregated statistics.

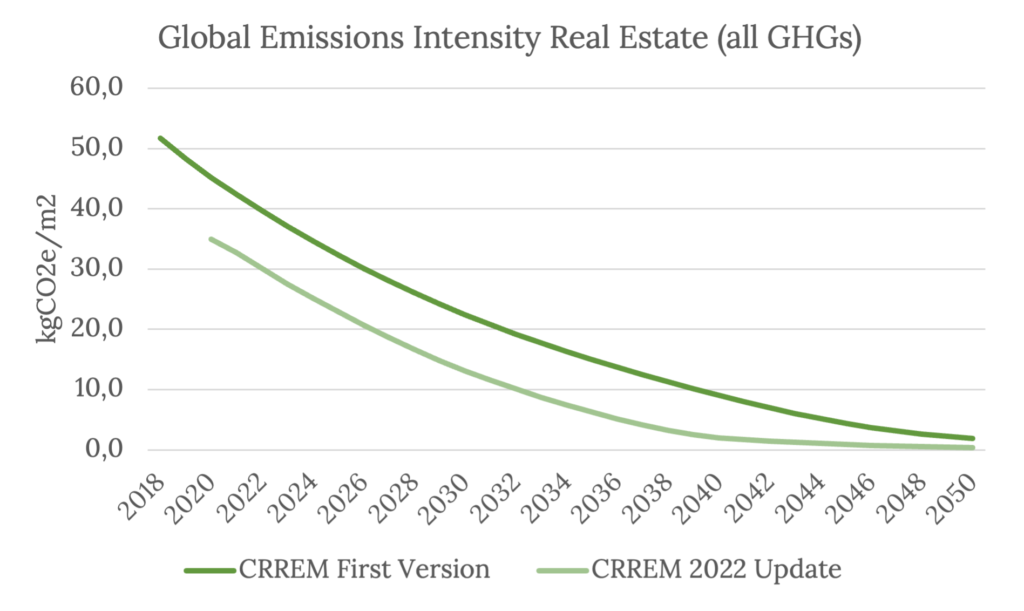

Comparison of level of ambitions of old and new version of CRREM-paths

The new pathways in cooperation with the SBTi have an adjusted ambition level in line with new scientific data. The overall ambition have increased as can be seen in the graph below. Additionally, the overall starting point has shifted to a higher level given too little abatement in the past years.

The increase in ambition is the effect of several factors in interaction. In the following the most material changes will be introduced.

- The first important difference is that the baseline year is now the year 2020 and not 2018 anymore. The sector has overshot its carbon budget in the years from 2018 to 2019. Therefore, the carbon budget needed to be reviewed for 2020-2050, making the transition curve steeper. The global anthropogenic carbon budget has been slightly reduced from 519 Gt CO2 to 486 Gt CO2 due to the aforementioned effect as well as the general use-up of carbon-budget over time. As a result, the real estate share of the global budget changed. It increased from 21.42 % to 22.95 %.

- Next, the building stock and floorspace growth rates were only slightly adjusted. Floorspace growth has increased by just 1.6 % over the full-time horizon until 2050 compared to the original assumptions. Still the increased floorspace overall leads to increased ambitions. The absolute amount of carbon budget gets divided by even more space and therefore demands even lower emission intensities.

- Furthermore, the electricity grid decarbonization has been progressing well in the past, reducing the power emission factor on average. Thereby, a lower absolute baseline for future emission factors is set. The decarbonisation of the grid is projected to be completed until 2040. However, the electrification of the real estate sector is overall increasing.

- Finally, also the methodology has changed in terms of its scope. The cooperation with the SBTi has led to the exclusion of transmission and distribution losses in the power emission factor and the emission budget. Therefore, only the primary energy demand is considered. The methodology of accounting for the total final energy demand was abolished. This was done to ensure scope-alignment and to follow best-practice by other initiatives.

Implications for companies in the real estate sector

A short-term implication of the updated pathways for companies, is that eventually the CRREM tool will be updated. The new version should then be used going forward to assess and price market risks in portfolios correctly.

In the long term the more ambitious pathways call for even more action of real estate companies when setting science-based decarbonisation targets. They will need to introduce faster decarbonization strategies and implement them in a timely manner in order to avoid stranded assets.

Sources

- CRREM (2022), CCREM Global Pathways, https://www.crrem.eu/wp-content/uploads/2022/10/CRREM_Global_Pathways-V2_PUBLIC-CONSULTATION-1.xlsx, published 10.2022.

- CRREM (2022), From global emission budgets to decarbonization pathways at property level, https://www.crrem.eu/wp-content/uploads/2022/10/2022-10-12_CRREM-downscaling-documentation-and-assessment-methodology_PUBLIC-CONSULTATION-1.pdf, published 10.2022.

- CRREM (2022), Press release “The SBTi and CRREM Join Forces to jointly provide fully aligned 1.5°C decarbonization pathways for the real estate sector!”, https://www.linkedin.com/posts/crreminitiative_sbti-crrem-join-forces-activity-6889128632745287680-y9aI?utm_source=share&utm_medium=member_desktop, published 18.01.2022

- CRREM (2021), CCREM Global Pathways, https://www.crrem.org/wp-content/uploads/2021/12/CRREM_Global_Pathways-V1.093.xlsx, published 21.12.2021.